Did you know that mobile banking apps have been around for over a decade? Did you know consumers prefer mobile to online banking? Did you know tech giants like Apple and Google are already in the game? If you already knew all of that, then this Statista report will come as no surprise: Today, most US banks offer mobile experiences. So, a mobile banking app is more of a catch-up game for smaller banks, and more so a battleground for fintech startups. Whether you’re looking for info on how to build a banking app to engage customers or have figured out a unique customer need that calls for mobile banking services — you are in the right place. You’ll learn about the different aspects of fintech app development and lots more.

If you’re reading this, you must be quite familiar with the market, but let’s quickly recap the state of affairs to make sure we’re on the same page about banking mobile app development.

According to an MX study , the deadly virus has definitely played its part in the 50% surge of mobile engagement with banks.

“Americans are turning to mobile banking as a way to take control of their finances and plan for their economic future.”

Ryan Caldwell, founder and CEO of MX

This growing demand for remote bank services may indicate that we’ll see more apps released by smaller banks, which have been slow on adopting mobility solutions. According to the FDIC, only 9.5 percent of Americans favored mobile banking in 2015; and in 2021 this number flipped to 43.5 percent.

Back in 2018, more than half of community banks didn’t have a mobile presence. Note how customer value a highly rated mobile app today, according to Forbes Advisor Feb 2023 Survey:

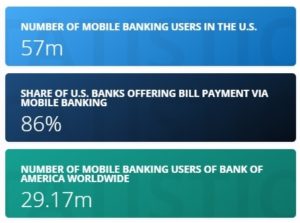

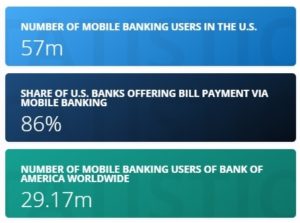

Research paints a bright picture, predicting almost a $2-billion milestone for this market by 2026, but the result remains to be seen. Here are some more reassuring stats:

Let’s explore the latest happenings in the mobile banking sector to understand growth challenges and identify some low-hanging fruit.

One of the biggest trends we notice lately is neobanks (startups without a banking license) are turning into challenger banks (those with a license). And traditional bank branches buy up or partner with both.

A case in point : Varo — a digital-only mobile financial service — will be moving its 2 million accounts from The Bancorp Bank to Varo Bank, after receiving approvals from the FDIC and Federal Reserve. Another example: Google is partnering with BBVA, Citi, and a handful of other financial institutions to bring accounts and other financial services into Google Pay in 2021.

As voice is becoming a ubiquitous tool for controlling mobile devices, banks are integrating their apps with Siri, Alexa, and Google Assistant. Alternatively, some choose to build their own voice assistants from scratch.

A case in point: US Bank has just launched an in-app voice assistant to help its customers quickly navigate the app amid pandemic using natural voice commands.

Chatbots are very similar to voice assistants, except they rarely talk, offer question templates, and overall resemble dumbed-down versions of AI-powered assistants. Still, millennials, who grew up on messaging, may prefer this navigation to find a specific service, transaction, or helpful tip.

A case in point : NOMI, Royal Bank of Canada’s chatbot serves 1.1 million customers per month. It has answered 1.9 million questions from customers since the bank added the new feature in spring 2020.

We can’t just miss AI and machine learning since they power pretty much the rest of the fintech revolution. But you get it, it’s everywhere.

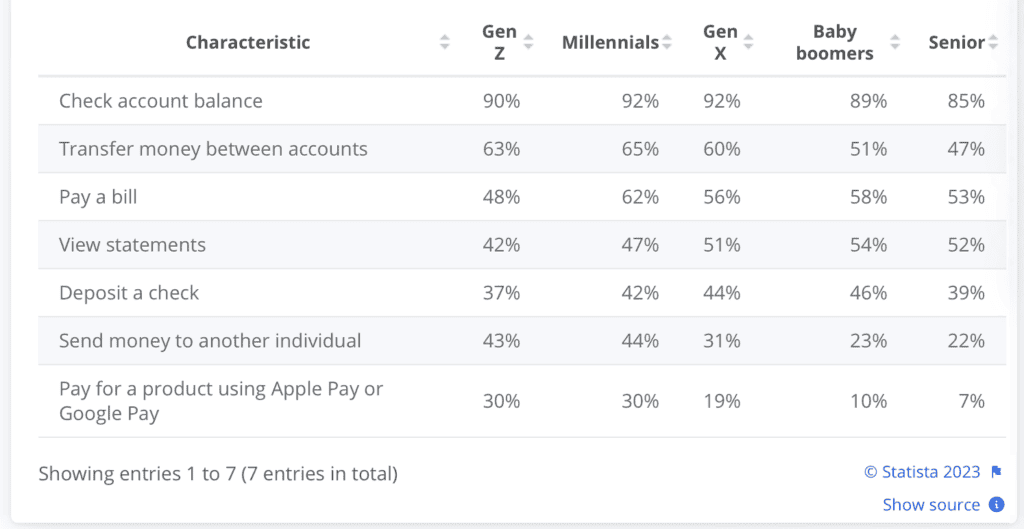

One thing to note about banking app trends is different cohorts use these apps differently. Here’s a report by Statista where they look at generations’ preferences with banking applications in the U.S.

Image credit: Statista (all image rights belong to Statista Inc.)

We picked 3 apps that we believe give you a snapshot of what’s really happening in the industry.

Why : JPMorgan Chase Bank is the largest bank in the US. It’s no wonder they have the biggest fan base hooked on their app: 38 million customers.

Highlights : One of the new features Chase Mobile has to offer is scanning paper receipts and automatically linking them to appropriate payments and transactions.

Why : Chime is one of the fastest-growing fintech companies innovating mobile consumer banking. They started in 2014, reached 1 million users in 2018, and catapulted to 8 million users in early 2020.

Highlights : Chime offers a free checking account with a fee-free overdraft service, salary advance, and a savings account. As a side bonus, Chime customers get to build their credit score using a credit card that works like a prepaid debit card.

Why : Wells Fargo is a well-established bank with the most active mobile users, with 5,295,688 reviews on Google Play and App Store combined.

Highlights : On top of the usual features you’d expect from a traditional bank, Wells Fargo keeps adding new innovative tricks like a highly personalized cashback rewards program. They even have a separate mobile app for younger customers.

Understanding the different types of mobile banking apps is essential for tailoring your mobile banking project development strategy to meet various user needs. Here’s a breakdown of the main types:

Retail banking apps are designed for individual consumers, providing everyday banking services right at their fingertips. Features typically include:

These apps cater to business clients, offering more advanced features to manage corporate finances. Key functionalities include:

Neobanks operate entirely online without traditional branch networks. They focus on delivering a seamless digital banking experience. Highlighted features:

Lending apps streamline the process of applying for and managing loans. They are popular among users looking for quick credit solutions.

Investment apps focus on helping users grow their wealth by providing access to various financial instruments.

Digital wallets facilitate secure and convenient transactions, storing payment information digitally.

By understanding these types of mobile banking apps, you can better plan your approach to developing a mobile banking application project that meets the diverse needs of today’s digital-savvy customers. Whether you’re focusing on retail banking, corporate finance, or innovative neobanking solutions, each type offers unique opportunities to enhance user engagement and satisfaction.

Why do we think our choice is characteristic of the current situation in the US mobile banking market? Well, the deal is neobanks and challenger banks take about 3% of the market share, and the big boys aren’t going anywhere. Instead, there are many partnerships, mergers, and acquisitions between mobile fintech startups and traditional banks.

Conventional banks are trying startup models to come up with new mobile products, and fintech companies, like Revolut , keep innovating from the other side. Both meet somewhere in the middle. I believe all fintech startups working on a mobile banking product seriously consider a buy-out or acquisition as a successful exit strategy from the get-go. And incumbent banks get a nice shot of innovation every time they acquire the results of mobile banking application development from startups.

Now, with that out of the way, we’ll focus more on how to code a banking app.

Long story short, banks cut operating expenses, sell more products per customer, and attract and retain more users when they’re able to provide outstanding mobile customer service.

Startups sell to traditional banks or eventually become banks and make money, generating on average 10-15% of the invested amount per year. That and customers’ cravings for a 24/7 mobile user experience make banking app development a no-brainer.

That’s it, and you already know it better if you’re in the business. Oh, and smaller banks and credit unions do play the catch-up game to retain their customers. All are good reasons to start a banking app.

Round two: Why should we create mobile banking apps? The advantages are numerous and multifaceted, particularly for financial institutions looking to stay ahead in the digital age.

Creating a mobile banking app not only fosters customer satisfaction but also drives growth and profitability for financial institutions.

For a secure and scalable banking app, collaborating with a custom mobile apps development company is key.

If you’re just starting to custom develop your app, it better live up to customers’ expectations. And they’ve had quite a while to grow them. Here are some basic features an average Joe expects from a modern banking app (minus the trivial stuff like customer support and showing the nearest ATM and branch locations).

At-a-glance balance and transaction history have become the cornerstones of a mobile app produced by banks. That’s usually the first thing end users see after onboarding an app: show them what they own and let them quickly find and identify transactions.

Mobile payments are why everybody loves banking from their sofas. Integrate with as many payment services providers as possible to allow your customers to pay for their everyday expenses, transfer money to friends and family, and pay off loans and mortgages. Ideally, they should be able to pay for anything at all. In that sense, banking apps act as pure payment systems.

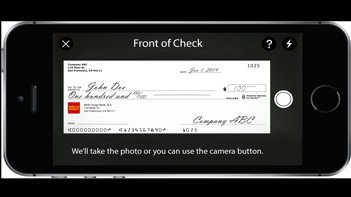

Another nifty feature that saves your customer a trip to the bank when they need to deposit a check. Instead, they take a photo of the check from both sides, endorse it, and upload it via the app.

These are push notifications nobody likes to miss. Besides offering account status updates, notifications may ask for authorizing a scheduled transaction, which users can greenlight with a single tap. That’s a perfect tool to get someone sign up for automatic pre-planned payments. There’s no developing smartphone banking apps without push notifications these days.

Customers should be able to block their credit and debit cards, assign them to a different account, set limits, change the PIN code, and do many other things that their banks support.

Robust security is everything, especially when it comes to personal finance. By adding support for fingerprint (e.g., Touch ID), FaceID sign-in, or other biometric authentication, you make your customers feel at ease and protected at the same time. And everybody likes to tap or glance at a phone to be able to sign in.

Ok, I’m on the fence with this one. On the one hand, all major smartphone banking apps show graphs or pie charts with the user’s expenses grouped by categories. On the other hand, if you’re just starting, that’s probably not something your customers can’t live without.

So much for the core features.

Now, suppose you want to create a banking application that will rise above the crowd. In that case, you should envision some unique value-adding features. And if you want to join the top ranks, consider adding the following functionality at minimum.

When I fire up my banking app, I get what I need right in front of me: the currency exchange rates, payment templates, balance, and pending transactions. How did I get this? My bank graciously allowed me to customize my screen this way by letting me toggle off and rearrange panes they display in the app. Of course, I’d prefer the app to do that automatically based on how I use the app, but we get what we get, right?

Being able to withdraw cash when you forget the card in your car is a big deal. Some apps will have QR codes or some other form of interaction with ATMs to let you in, even when you don’t have a card.

Easy access to the rest of bank products within a mobile app ensures you will get maximum value per customer. At the same time, customers can take out a loan right where they are, in the moment, without having to visit a physical office.

The cherry on top, that’s what a robust chatbot or voice assistant can become to your app. Bank of America reported that only 1% of their mobile customers (of over 27 million) turn off Erica, their AI-enabled chat & voice assistant — a user-friendly conversational interface.

In addition to regular notifications informing users about their recent transactions and balance status, you can enhance the app with alerts that trigger based on different criteria. Such alerts will pop up upon reaching daily or monthly expense limits for particular types of transactions, etc.

An Apple Watch app can be a nice addition allowing customers to quickly view their balance or make secure payments in stores. Remember, an intuitive interface here means that you don’t need to pack a whole lot of features on a tiny screen; just offer your customers glanceable experiences.

Stock and bond investment can play its part in a banking application. Even though major players prefer to develop a separate mobile solution for investing purposes, there’s nothing stopping you from providing the basic buy and sell options right inside the main banking application.

Crypto is a shady topic when there’s a bear market, but during the next bull run everybody is going to be talking about it again. If your customers are interested in crypto, the least you could do is partner with companies that offer major coins, e.g., Bitcoin and Ethereum, for trading. And of course, modern banking apps can benefit from incorporating crypto functionalities, like guiding users through setting up a crypto wallet for their digital currencies.

Ok, that’s it for the key features. Now, let’s move on to discuss the nuances of mobile application development for banking.

Let’s quickly review all the steps before going into the details. Here’s the list of major steps you go through during the development of mobile banking solutions:

And now let’s talk about the essence of digital banking app development.

You’re probably thinking, “I need to figure out the app’s architecture first: Do I want it built as microservices or SOA? What programming language should I choose?”

While those are important decisions, you should start by focusing on your customers. What business needs are you trying to cover with an app? How and when are they likely to use the solution? These and many other questions will help you answer your main question, “How to make a banking app?”

To answer these questions, you build a prototype and test it with your target audience to see if they are using it the way you envision. The prototype is confined to working on the app design, and no coding is required.

Fortunately, a prototype requires 10x fewer resources to build and verify than developing a full-fledged mobile app. And developing a smartphone banking app is no easy feat, requiring lots of resources (more on that later).

A business analyst will then help you use customer feedback to iterate on the prototype until everybody is happy with the customer experience.

This approach implies that you’ll be ready to develop a solution with a proven product-market fit without wasting your resources. Fortunately, changes at the UI/UX design step don’t cost a fortune.

Whether you’re a traditional bank or a startup looking to revive mobile banking, customers expect top-notch security. After all, they are trusting the app with their money. So, you have to develop a secure mobile banking app, ensuring data safety.

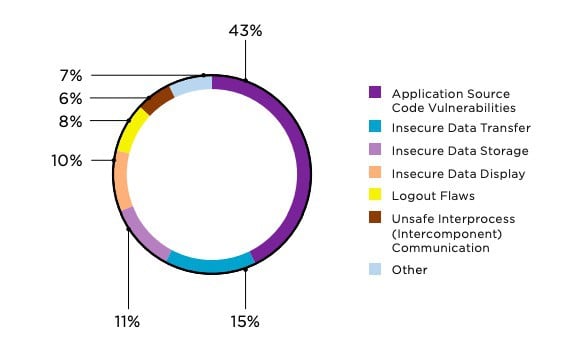

Positive Technologies have recently published their findings based on the research of vulnerabilities and threats in mobile bank solutions for several large banks. They’ve discovered somewhat not very comforting security measures in place:

Not only do you need to protect your app and the server-side, but you should also inform customers (and your employees) about cybersecurity best practices. On the app’s side, you need to consider:

Some of the top-of-the-line safeguard practices that make a mobile banking app more secure include:

You should also remember the user comfort and include features that simultaneously protect and simplify app usage when you create a bank app:

Programming the app will be the most time-consuming step. That’s when banking app developers take the prototype and turn it into a live app. And even though your mobile banking development process will largely depend on the specifics of the product, some general recommendations can help you transition smoothly. [#protip: partner with an experienced product development company]

We recommend using native programming languages. The typical technology stack includes Swift for iOS and iPad OS and Kotlin or Java for Android. Those are officially supported by Apple and Google and provide you with full control over every aspect of the app.

If you’re playing a catch-up game, though, and need to push something quickly to stop customer drain, React Native or Flutter is a viable cross-platform option for simultaneous iOS and Android banking app development. You get an iOS and Android version on a smaller budget and faster with this tech stack.

If you only want to build Android banking apps (let’s say all your customers are on Android phones), then your choice is Kotlin.

Setting up your banking app development process the Agile way gives you these benefits:

Another buzzword you may think, but wait. If you spend time at the beginning of the project to set up a DevOps environment and procedures properly, what you get later is regular updates to your apps.

Continuous integration and delivery tools ensure your developers can focus on adding features and fixing issues — app updates ship as if by themselves. With DevOps, coders spend zero time fiddling around preparing another version for testing; instead, they create a banking application in Android and iOS full steam ahead.

We recommend using the least amount of open-source or commercial code in your app. Only if you can thoroughly test code for vulnerabilities and modify it yourself should you consider using third-party solutions. The thing is these products keep developing, and their updates can break your app. So even if you choose to do so, pick trustworthy suppliers, like Plaid, Ficinity, or Quovo.

Testing starts as soon as developers have shipped a feature or two. That goes back to Agile, which involves testing the app after each iteration (usually 2 weeks). Needless to say, you should run regression and unit tests before releasing your mobile banking solution to a small, controlled group of loyal users.

As with any sizeable project, you can’t do without automated tests during mobile banking software development. So, make sure your software development company sets these up from the get-go; long before you plan to launch the product.

We’ve already mentioned Plaid, an API that allows fintech apps to connect with user bank accounts (with their permission), but there are other third-party services you could use in your app.

A good example is Zelle. This service has found its way into many banking apps for simplifying cross-bank money transfers. With Zelle, users can send payments to friends and family regardless of the bank they’re using.

Another service you may find useful is Docusign. It can help you easily create mobile-friendly agreements that users can sign right on their mobiles. Let us know about your goals with the banking solution you envision, and we’ll recommend appropriate vendors.

The most pleasant and rewarding stage of the entire adventure, right? Only if you have the right development partner who will help you get through a thorny maze of the review process in the App Store and Google Play. And remember to stress-test your servers to ensure customers won’t bring it down on the release day.

And that’s how you create a mobile banking app with the potential to generate real traction with users.

Developing a mobile banking application comes with its own set of challenges. Understanding these hurdles is crucial for a successful launch.

To successfully create a bank app, developers must navigate these challenges with expertise and careful planning.

When you set out to develop an online banking application, choosing the right tech stack is critical for ensuring optimal performance, security, and user experience. Here are key components to consider for banking and finance app development:

By leveraging the right technology stack, you can ensure that your mobile banking app is secure, scalable, and offers a seamless user experience.

Before you go and raise money to build your own banking app, let’s discuss how much you’ll need approximately. How much does it cost to create a banking app?

A couple of millions with an in-house development team, and between $300,000–$500,000 with a contractor team. That’s an approximate price range for building a banking app from scratch. And if you are a fintech startup looking to address a niche customer need with a mobile app, the cost of developing your app should squeeze within the $180,000–$260,000 range to get the first working MVP out.

Annual maintenance will end up at around $130,000 for the two variants, respectively. But the long-term investment strategy for such an app should absolutely base north of $1 million. How long it takes to develop your app will depend on the team involved, features of the app, but anything between four to six months for a proof of concept is what we’ve seen depending on the specific features and complexity of the app. A dedicated team can get a releasable MVP ready within 9-14 months.

To give you one example, a new mobile banking startup called Step had raised $3.8 million in a seed round before they got $22.5 million from Stripe and started building a full version of their teen-oriented mobile banking app.

Topflight collaborated with Coronation Group to develop an intuitive investment and wealth management app tailored for the Nigerian market. Here are the key highlights of the project:

Read more about this case study here.

I’m sure you have at least a dozen other questions we haven’t covered in this guide. Please check out the FAQ section below to see if you get answers to “How to create a banking app”. If you want to discuss some aspects of your mobile banking app development in more detail, schedule a call with us . We’ll make sure you’re covering all the bases before plunging into the exciting world of mobile banking.

Ready to start a mobile banking app?

[This blog was first published in September 2020 and was updated in May 2024 with more recent information]